Hyperlink: Apply now for the Citi® / AAdvantage® Government World Elite Mastercard®

The Citi® / AAdvantage® Government World Elite Mastercard® (assessment) is American Airways’ most premium bank card. Whereas the cardboard has a $595 annual charge, it gives all types of perks, together with an Admirals Membership membership.

For these trying to qualify for elite standing with American AAdvantage, some of the attention-grabbing features of the cardboard is the power to earn Loyalty Factors. Whereas most co-branded American AAdvantage bank cards allow you to earn Loyalty Factors, this card gives the power to earn 20,000 bonus Loyalty Factors per yr unrelated to spending, which is a perk you gained’t discover on every other card.

On this put up I wished to take a better take a look at how that works.

Incomes Loyalty Factors with the Citi AAdvantage Government Card

Loyalty Factors is the title of the system by which you’ll earn elite standing with American AAdvantage. Standing with the airline now not has something to do with how a lot you fly, however somewhat has to do with what number of Loyalty Factors you rack up, no matter whether or not it’s from flying or non-flying actions, like bank card spending.

As a reminder, for the 2024 program yr, listed here are the AAdvantage elite standing necessities:

Additionally understand that American has the Loyalty Level Rewards program, permitting you to earn additional perks, like systemwide upgrades, for passing sure thresholds.

So, how does the Citi AAdvantage Government Card issue into all of this? Let’s speak about how you need to use the cardboard to earn Loyalty Factors for spending, and in addition how one can earn Loyalty Factors only for having the cardboard.

Earn one Loyalty Level per greenback spent

Like most American Airways bank cards, the Citi AAdvantage Government Card gives one Loyalty Level per eligible greenback spent on the cardboard. In different phrases, spending $200,000 on the cardboard would earn you 200,000 Loyalty Factors (and in flip, Government Platinum).

Notice that miles earned from the welcome bonus, in addition to miles earned from spending multipliers, don’t earn you further Loyalty Factors. For instance, the cardboard earns 4x AAdvantage miles on American Airways purchases. So whilst you’d get 4 redeemable miles per greenback spent on these purchases, you’d solely earn one Loyalty Level per greenback spent.

Earn 20,000 bonus Loyalty Factors per yr

That is the place the Citi AAdvantage Government Card will get attention-grabbing, and gives one thing you gained’t discover on every other American Airways bank card. Those that have the Citi AAdvantage Government Card can earn as much as 20,000 bonus Loyalty Factors per yr, with out truly needing to spend a dime on the cardboard:

- Earn 10,000 bonus Loyalty Factors once you earn 50,000 Loyalty Factors in a standing qualification yr

- Earn 10,000 bonus Loyalty Factors once you earn 90,000 Loyalty Factors in a standing qualification yr

In different phrases, should you’d ordinarily earn 90,000 Loyalty Factors in a yr, having this card would earn you 20,000 bonus Loyalty Factors. There’s not one other American bank card that provides bonus Loyalty Factors only for surpassing sure thresholds in this system, unrelated to card spending.

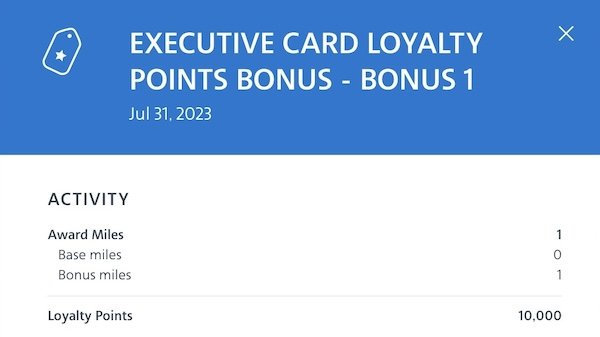

For instance, beneath is a take a look at how the 20,000 bonus Loyalty Factors posted to my AAdvantage account final yr. This was based mostly purely on having the cardboard, and never based mostly on any bank card spending.

Simply to cowl a few of the fundamental questions individuals could have about this perk:

- Bonus Loyalty Factors will formally put up inside 8-10 weeks of assembly the Loyalty Factors requirement; nonetheless, in apply they appear to put up a lot sooner than that

- You possibly can earn at most 20,000 bonus Loyalty Factors from from this card per standing qualifying yr, not accounting for the Loyalty Factors you earn for spending (the standing qualifying yr goes from the start of March till the tip of February of the next yr)

- You’re nonetheless eligible for this profit should you open your card through the standing qualifying yr; so that you don’t have to have the cardboard open initially of the membership yr to qualify for this, however somewhat the bonus Loyalty Factors will put up retroactively

- The primary threshold of 10,000 bonus Loyalty Factors counts towards the second threshold; in different phrases, should you earned 80,000 Loyalty Factors exterior of this profit, you’d earn 20,000 bonus Loyalty Factors, because the first bonus of 10,000 Loyalty Factors would set off the second bonus (by getting you to 90,000 bonus Loyalty Factors)

How worthwhile is that this Loyalty Factors perk?

When you’re going for elite standing with American AAdvantage, how worthwhile is the chance to earn Loyalty Factors with the Citi AAdvantage Government Card?

With regards to incomes one Loyalty Level per greenback spent, I’ve written prior to now about my ideas on the worth proposition of that:

- I don’t suppose it’s price spending your means all the best way to elite standing, although on the margins I feel it could possibly be worthwhile (say you’d earn 125K Loyalty Factors by means of flying, after which earn 75K Loyalty Factors with a bank card, to earn Government Platinum)

- There’s simply such a chance price to spending on an American bank card. vs. one other card that could be extra rewarding when it comes to on a regular basis spending, bonus classes, and so on.

I feel the extra attention-grabbing query is the worth proposition of incomes as much as 20,000 Loyalty Factors only for having the cardboard. When you’d in any other case earn 90,000 Loyalty Factors per yr, is that alone a cause you need to get this card?

- The cardboard has a $595 annual charge, so should you don’t worth any of the perks of the cardboard, that will be like “shopping for” Loyalty Factors for just below three cents every (with none corresponding redeemable miles); I wouldn’t take into account that to be a tremendous deal

- Loyalty Factors are most respected in the event that they allow you to attain a particular threshold (both for elite standing or Loyalty Level Rewards), although understand that the upper your Loyalty Factors whole, the upper your improve precedence

- Personally I wouldn’t get the cardboard solely for the 20,000 bonus Loyalty Factors, although somewhat I’d view it as a part of a collection of advantages; personally I discover the annual charge justifiable based mostly on the Admirals Membership membership, the 20,000 Loyalty Factors, and all the different perks, together with as much as $360 in credit yearly with Avis/Price range, Grubhub, and Lyft

- If I needed to put a valuation to the 20,000 bonus Loyalty Factors, I’d most likely say that to me they’re price $200-300

Backside line

The Citi AAdvantage Government Card is American’s most premium bank card. Along with the cardboard providing one Loyalty Level per greenback spent, you may as well obtain as much as 20,000 bonus Loyalty Factors per yr only for being a cardmember, assuming you earn a minimum of 90,000 Loyalty Factors.

That is the one American bank card that provides bonus Loyalty Factors with none kind of a spending requirement. So should you’re into the AAdvantage program, that perk is a cause to significantly take into account the cardboard, along with all the opposite advantages.

What do you make of the Loyalty Factors perks provided by the Citi AAdvantage Government Card?