Hyperlink: Apply now for the Ink Enterprise Most well-liked® Credit score Card, Ink Enterprise Money® Credit score Card, or Ink Enterprise Limitless® Credit score Card

The portfolio of Chase Ink Enterprise playing cards are among the many most profitable bank cards on the market, by way of their total worth proposition. The playing cards have glorious welcome bonuses, an incredible return on spending, and offer you entry to the Final Rewards ecosystem.

Whenever you apply for a enterprise bank card, you sometimes don’t want a company, as you can even apply as a sole proprietorship. On this submit I needed to speak about that in a bit extra element, and share one of the best ways to go about this. That is one thing that confuses many individuals, and also you could be shocked by the success you could have.

Fundamentals of Chase Ink Enterprise playing cards

For a little bit of background, let me very briefly cowl the main points of the three hottest Chase Ink Enterprise playing cards that earn factors:

- The Ink Enterprise Most well-liked® Credit score Card (overview) has a $95 annual price, and is without doubt one of the most well-rounded enterprise playing cards, with an enormous welcome bonus, beneficiant rewards construction, cellphone safety, rental automotive protection, and rather more

- The Ink Enterprise Money® Credit score Card (overview) has no annual price, and gives 5x factors bonus classes, making factors rack up shortly, particularly with the welcome bonus

- The Ink Enterprise Limitless® Credit score Card (overview) has no annual price, and is without doubt one of the finest Chase enterprise playing cards for on a regular basis spending

Chase Ink Enterprise playing cards aren’t mutually unique. You may apply for all of the playing cards and earn the bonuses (you’ll be able to even get the identical card for a number of companies, when you’ve got a couple of enterprise), and so they make glorious enhances as effectively.

Now, whereas I’m focusing totally on the Chase Ink Enterprise card portfolio, the identical basic rules of making use of for a card as a sole proprietorship apply on different playing cards, just like the Southwest® Speedy Rewards® Efficiency Enterprise Credit score Card (overview), World of Hyatt Enterprise Credit score Card (overview), IHG One Rewards Premier Enterprise Credit score Card (overview), and so on.

Chase Ink Enterprise card sole proprietorship utility

You don’t have to have a company to select up a enterprise bank card, however somewhat a sole proprietorship would usually qualify as effectively. So let’s discuss that in a bit extra element — what’s a sole proprietorship, what do it’s good to qualify for one, and the way must you apply for a enterprise bank card utilizing this technique?

What’s a sole proprietorship, and who’s eligible?

A sole proprietorship is probably the most primary type of a enterprise, the place it’s owned and run by one particular person, and isn’t integrated. The proprietor has limitless legal responsibility, and the enterprise has no authorized existence, separate from the proprietor. The proprietor experiences the enterprise’ revenue on their private tax return, and pays federal and state revenue tax on income.

Now, I’m clearly not hear to advise as to what sort of a enterprise somebody ought to arrange (it’s best to speak to a tax skilled about that), however in most locations there’s actually no barrier to having a sole proprietorship, because it doesn’t even require registering in any official capability.

For many individuals, a aspect hustle might very effectively be thought-about a sole proprietorship, whether or not you could have a property you lease out, you do consulting, you’re a contract author, or no matter. There’s worth to with the ability to separate your small business bills out of your private bills, and naturally the very profitable enterprise playing cards that we see don’t harm both. 😉

How must you fill out an utility with a sole proprietorship?

Whenever you’re filling out a enterprise card utility as a sole proprietorship, how must you go about doing so? For instance, I not too long ago utilized for the Ink Enterprise Most well-liked® Credit score Card as a sole proprietorship, as I have already got the cardboard for my company.

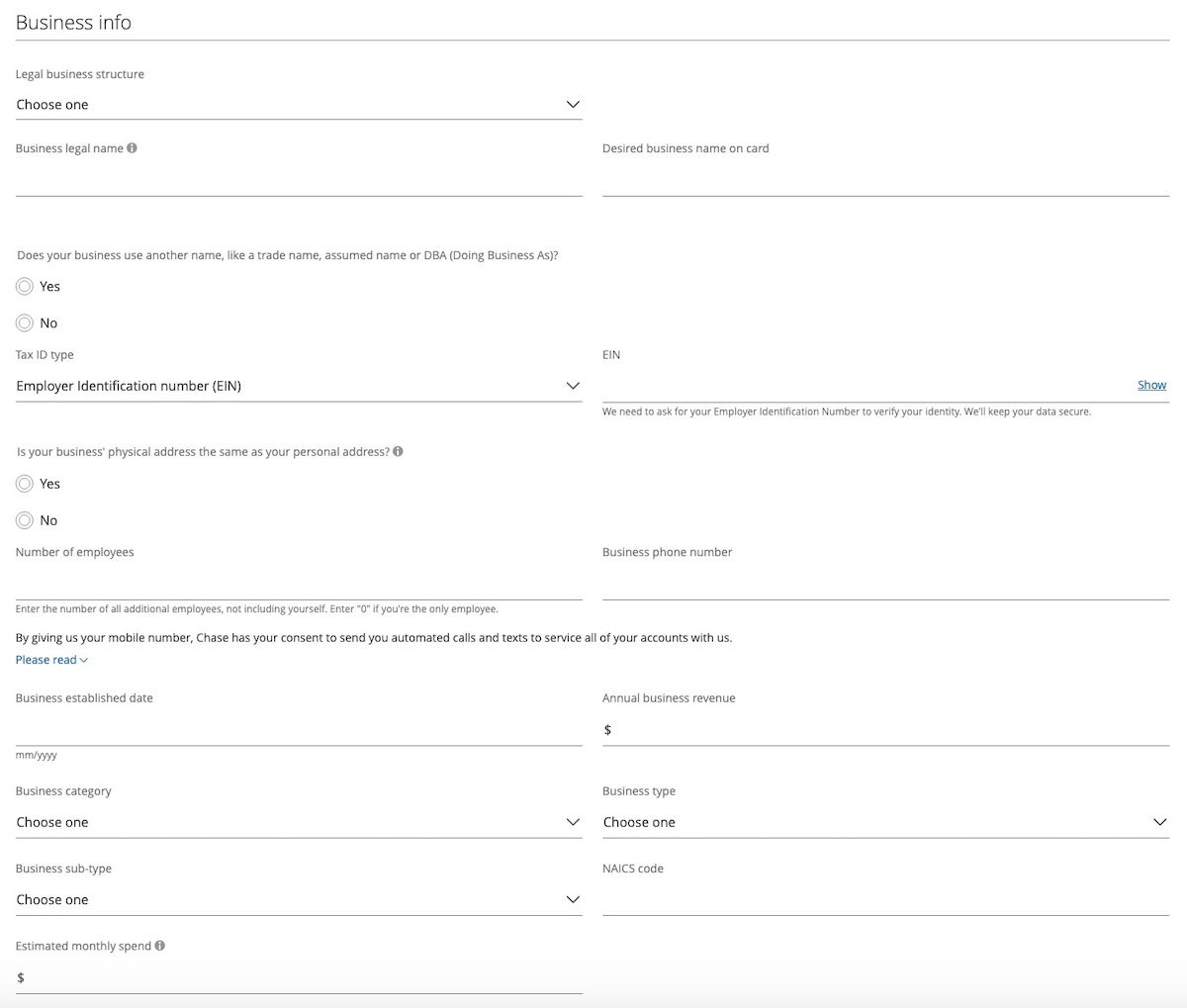

Whereas Chase card purposes at all times require offering primary private data, let’s speak a bit concerning the part that asks for enterprise data, and the way to go about filling this out for a sole proprietorship:

- For authorized enterprise construction, you’ll be able to choose “sole proprietorship”

- For the authorized enterprise title, you’ll be able to simply use your title

- For the tax ID sort, you’ll be able to choose “social safety quantity,” after which enter your private one

- For the variety of staff you’ll be able to choose “one,” and your small business telephone quantity will be your private quantity, if that’s what you utilize

- For the enterprise institution date and enterprise income, simply present that data as requested

- For the enterprise class, choose no matter finest matches what your sole proprietorship does

For extra particulars, I not too long ago wrote about Chase Ink Enterprise card eligibility necessities, and my expertise getting authorized with a sole proprietorship. Additionally do not forget that because of the Chase 5/24 rule, there’s usually advantage to making use of for enterprise playing cards earlier than private playing cards.

What are your odds of being authorized with a sole proprietorship?

You must at all times fill out bank card purposes in truth. To be authorized for a enterprise bank card, you don’t want a enterprise with one million {dollars} in income yearly, and with a dozen staff. Loads of individuals get authorized for enterprise playing cards as a sole proprietorship, with one worker, with restricted enterprise income, and with restricted historical past.

Now, are you prone to be authorized in the event you say you could have zero income, and the enterprise is model new? Properly, it’s potential, however odds in all probability aren’t wonderful. The extra historical past and the extra income you could have, the extra probably you might be to be authorized. That’s very true when you’ve got an incredible credit score rating.

Everybody ought to use their very own judgment when making use of for bank cards primarily based on their very own scenario. Assuming you could have a wonderful credit score rating, there’s enormous upside to making use of, whereas there’s restricted draw back.

Usually your rating will get dinged a number of factors briefly for the credit score inquiry, however there aren’t any main implications within the occasion you get denied. Enterprise bank cards usually even have a restricted impression in your private credit score rating.

Backside line

Chase has a wonderful portfolio of enterprise playing cards, particularly the Ink Enterprise Most well-liked® Credit score Card, Ink Enterprise Money® Credit score Card, and Ink Enterprise Limitless® Credit score Card. Whereas it’s usually individuals with companies who apply for enterprise playing cards, you don’t really need one to be authorized.

You may also apply as a sole proprietorship, and hopefully the above gives a primary rundown on how to take action. I do know making use of for enterprise playing cards will be intimidating, however many individuals are additionally pleasantly shocked by the outcomes.

Should you’ve utilized for a enterprise card as a sole proprietorship, what was your expertise like?