In a growth that may shock no person who has been following the airline, Air Belgium is as soon as once more on the point of liquidation. Now, it is a acquainted story, as Air Belgium appears to have 9 lives. Nevertheless, the state of affairs is certainly extra dire than previously, and I don’t see how this may have a constructive end result…

Some background on Air Belgium’s struggles

For many who aren’t accustomed to Air Belgium, let’s begin with some background. The airline was based in 2018, and seemingly hasn’t had success with something, however it’s nonetheless (kind of) in enterprise:

- The airline began service with Airbus A340s, and initially flew between Charleroi Airport (exterior of Brussels) and Hong Kong; the provider’s long run plan was so as to add routes from Charleroi to mainland China, and have that be the main focus

- Inside a matter of weeks, the airline suspended that route, realizing it wasn’t precisely an incredible enterprise mannequin; that was the final we ever heard of Air Belgium working passenger flights to China

- At this level the airline centered on changing into a moist lease operator, working flights for different airways that wanted additional capability; the timing of this was good, as many 787s had been grounded as a result of engine points on the time

- In October 2018, the airline was on the point of liquidation, and an emergency normal assembly was held to determine whether or not or to not dissolve; the corporate ended up getting extra funding

- In July 2019, the airline introduced it will resume frequently scheduled flights, however would fly to the Caribbean as a substitute of China

- In June 2020, the airline introduced it will swap from Charleroi Airport to Brussels Airport, and would launch new routes, together with flying to Africa

- In July 2021, the airline introduced it will purchase two Airbus A330-900neos, and use these for passenger flights, changing Airbus A340s

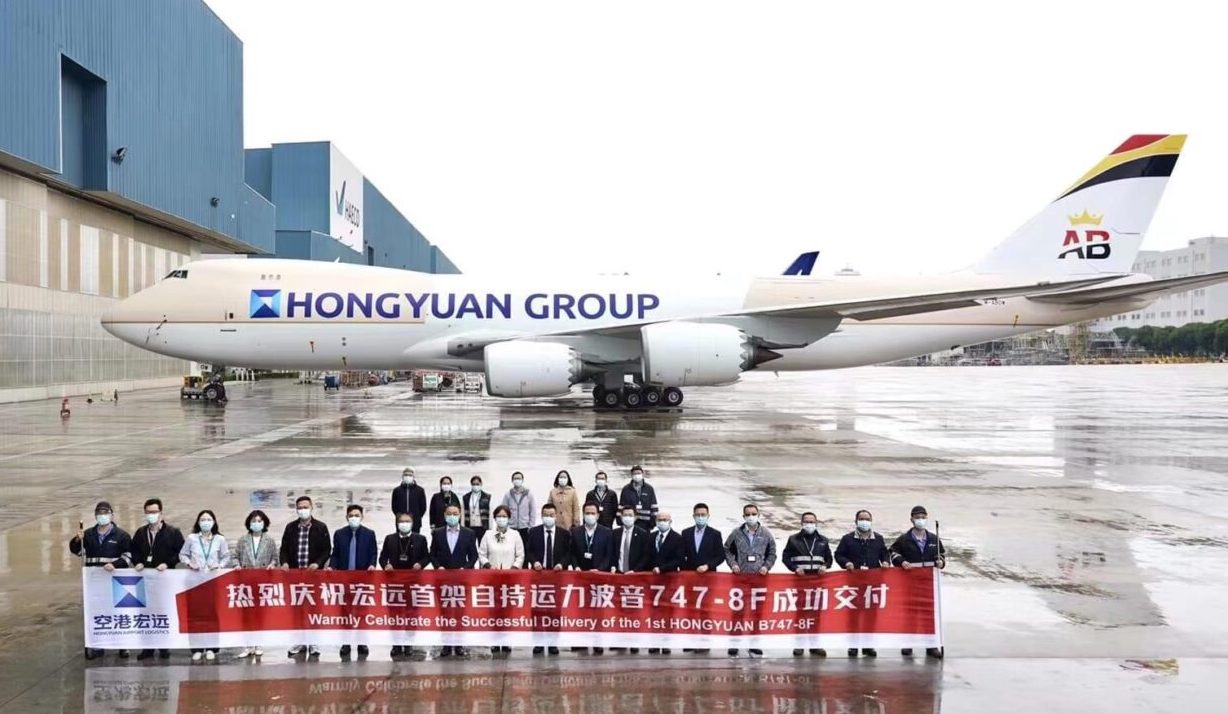

- In December 2021, the airline introduced it will add Boeing 747-8Fs to its fleet, and increase devoted cargo operations

- In November 2022, the airline was reportedly on the point of chapter, however the airline managed to lift some extra capital final minute

- In March 2023, the airline minimize flights to the Caribbean, as they had been unprofitable, and as a substitute centered on Africa

- In September 2023, the airline minimize scheduled passenger flights altogether, as a substitute specializing in cargo and moist lease operations

I nonetheless assume again fondly on my Air Belgium flight from Charleroi to Hong Kong, which needed to be one of the weird flights I’ve ever taken. It had a complete of simply 25 passengers onboard. It’s not typically that the under footage are what a cabin seems like whereas enroute on an extended haul flight.

Air Belgium is operating out of cash once more

A couple of yr in the past, Air Belgium began a reorganization course of, whereby the airline discontinued frequently scheduled flights. Even with these modifications, the airline continues to be dropping some huge cash.

As you’d anticipate when discontinuing frequently scheduled flights, the provider’s income fell drastically, by roughly 40%. Within the first half of 2024, the airline had income of €156 million, in comparison with €258 million in the identical interval the yr earlier than. In the meantime losses have totaled €22 million. Air Belgium has been working two freighter Boeing 747s, plus two Airbus A330s.

Sadly Air Belgium now appears to be operating out of choices:

- Air Belgium had reportedly been in negotiations with Sichuan Airways for a potential deal on cargo operations, however that didn’t find yourself materializing

- Air Belgium wants to lift €18 million by September 19, 2024, with a purpose to keep in enterprise

- One potential investor has supplied €6 million in alternate for a 75% stake within the firm, although this deal is contingent on the federal government offering as much as €12 million in extra funding, with out growing its stake

- The provider has the additional situation of doubtless having its Belgian working license suspended if the international possession stake is elevated, as Air Belgium is already almost half owned by China’s Hongyuan Group

So we’ll see how this performs out. The airline has simply over per week left to get new funding, or it’s going to must liquidate. In equity, the airline has managed to keep away from liquidation a number of occasions now, however it doesn’t appear to me like Air Belgium has many levers left to drag.

I can’t think about what logical justification one may have for investing in Air Belgium at this level, as I’m undecided the place the upside is. The airline is dropping cash with cargo and moist lease operations, and I’m undecided buying 4 random planes is admittedly value a complete lot, particularly with the corporate’s debt.

Backside line

Air Belgium is as soon as once more on the verge of liquidation. The airline has till September 19 to seek out new buyers, or else it will likely be compelled to liquidate. All offers up till this level have fallen by way of, and on high of that, Air Belgium is proscribed by way of its potential funding choices.

It amazes me that Air Belgium has remained in enterprise for therefore lengthy, given the constant losses we’ve seen on the provider, plus the shortage of upside.

What do you make of Air Belgium’s odds of survival?