I usually get requested how a lot I worth varied miles & factors currencies, together with these issued with bank cards, airways, and inns. The reality is that there’s no valuation for these currencies that everybody will agree on. That’s as a result of the worth that you simply’ll get from rewards factors will fluctuate considerably based mostly on the way you redeem them, and that’s additionally largely based mostly in your journey objectives.

Nonetheless I attempt to use my data of those applications to assign a price to every forex, which might fluctuate over time. Under I’ll share my up to date valuations of many main miles & factors currencies, after which afterwards I’ll clarify my methodology. Observe that I’ve adjusted my valuation of many currencies, to replicate the devaluations we’ve seen not too long ago.

Worth of financial institution & bank card factors March 2024

To me, transferable bank card factors are the gold customary of rewards currencies. They provide a ton of flexibility, since you’ll be able to switch them to all types of companions. On high of that, there are such a lot of profitable bank cards that provide beneficiant rewards buildings for incomes these factors.

Personally I all the time attempt to earn transferable factors currencies with my bank card spending. In contrast to different factors currencies, I worth these roughly the identical, given simply what number of companions every program has.

Under are my valuations of the most important transferable factors currencies.

Worth of airline miles March 2024

There are many methods to earn airline miles, from truly flying, to utilizing co-branded airline bank cards. The worth of airline miles does fluctuate considerably between applications. It’s necessary to needless to say main airways have a lot of companions, so the worth of those miles isn’t simply based mostly on the power to redeem for journey on that specific airline, but in addition based mostly on the power to redeem for journey on associate airways.

Under are my valuations of the most important airline mileage currencies.

My valuation of rewards currencies are supposed to be conservative by design, so that individuals don’t unnecessarily or unrealistically hoard their factors.

Worth of lodge factors March 2024

Very like with airline miles, lodge factors will be earned both via staying at inns, or by utilizing co-branded lodge bank cards. Usually lodge factors are simpler to redeem than airline miles, provided that there aren’t as many capability controls or restrictions when redeeming them. That’s one of many purpose many favor to earn lodge factors fairly than airline miles.

Under are my valuations of the most important lodge factors currencies.

I haven’t lowered my valuations of any of those currencies for fairly a while. Why? Whereas extra factors at the moment are wanted for a lot of lodge stays, income charges have additionally gone up significantly. Some would possibly argue “effectively flight prices have gone up as effectively.” That’s not unfaithful in economic system, however usually my valuation of miles is predicated on aspirational redemptions, and the price of first and enterprise class tickets hasn’t essentially gone up.

Tips on how to go about valuing miles & factors

With the above out of the way in which, how do I truly go about developing with a price for miles & factors? To start with, let me share that I’ve been obsessive about miles & factors for 15+ years. Holding observe of those applications is my ardour (and my job), and I’ve additionally helped folks redeem effectively over a billion miles through the years. I’d wish to suppose I’ve a little bit of expertise.

Even so, that’s to not say that it’s best to worth miles & factors the identical manner I do. Let me share some fundamentals on how I’m going about valuing miles & factors, and everybody can determine for themselves how they wish to go about it.

Miles & factors can’t be valued objectively

Miles & factors are finally a type of forex, so that you may be questioning why we will’t worth them objectively. In spite of everything, there are alternate charges between financial currencies, regardless that various factors impression their valuations.

There are a number of causes miles & factors (at the very least for non-revenue based mostly applications) can’t be valued objectively in a helpful manner:

- There are such a lot of other ways to redeem miles & factors, which offers you vastly completely different valuations

- There’s usually not a technique to “money out” your miles & factors, and when there’s, that’s usually not essentially the most environment friendly manner to make use of them

- Everybody has completely different journey objectives, and also you’ll get completely different worth relying on whether or not your precedence is taking the household to Disney World, or flying top notch to Singapore

- Miles & factors will be devalued over time, and are usually the property of the loyalty program fairly than the member, so actually we’re simply enjoying by the applications’ video games

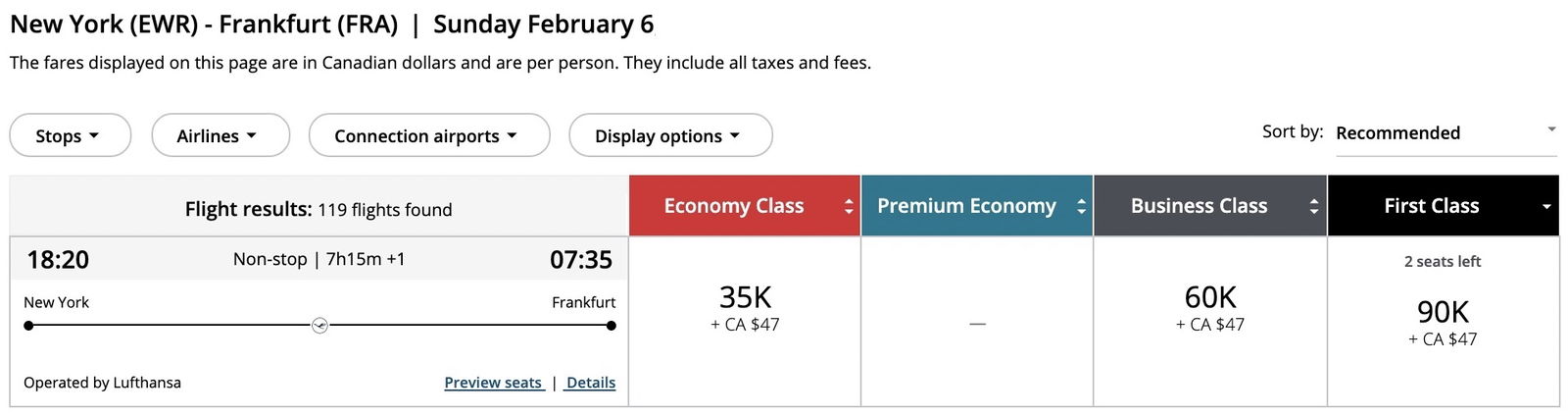

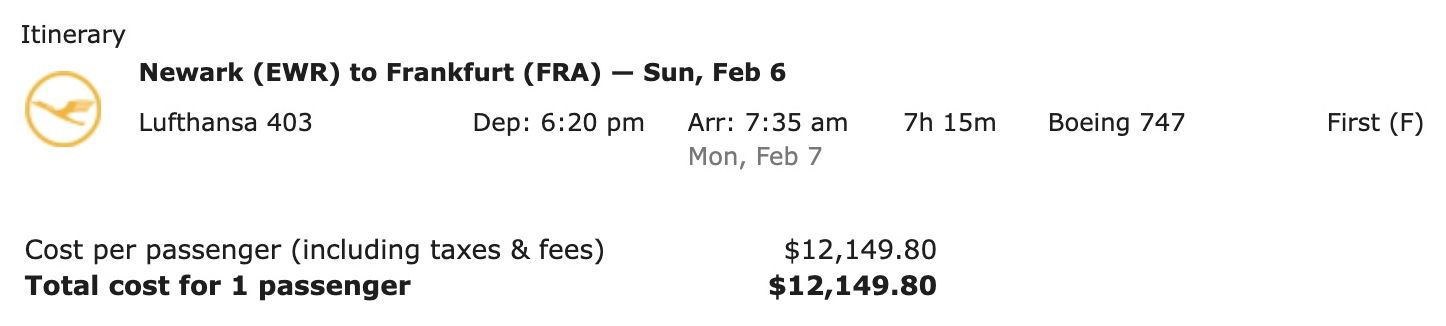

Let me give a concrete instance of why there’s no appropriate goal valuation of rewards factors. Let’s say you could have Capital One miles, which I worth at 1.7 cents every, and also you switch these to Air Canada Aeroplan. You might redeem 90,000 factors for a one-way ticket in Lufthansa top notch from Newark to Frankfurt.

In the meantime if paying money, that ticket would value over $12,000.

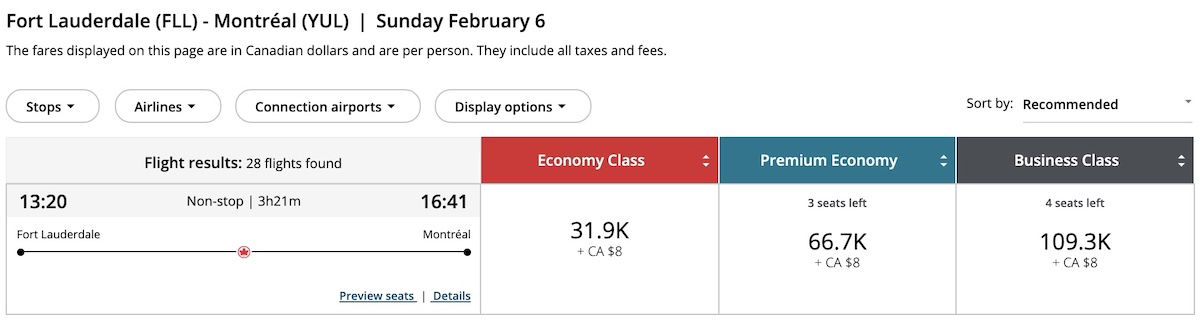

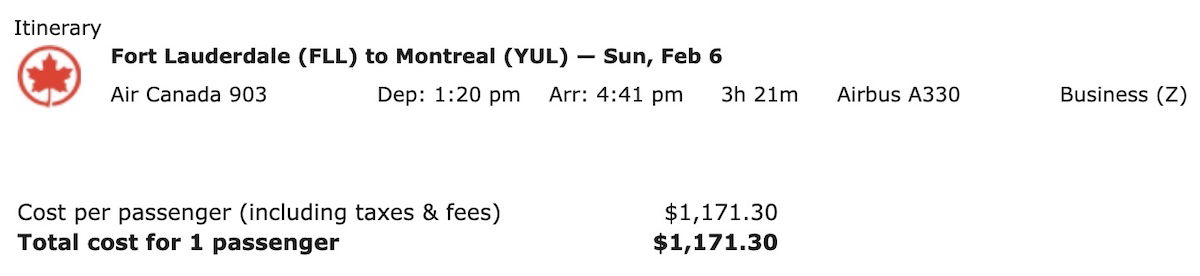

Alternatively, you might redeem 109,300 miles for a one-way ticket in Air Canada enterprise class from Fort Lauderdale to Montreal.

In the meantime if paying money, that ticket would value $1,171.

As you’ll be able to see, you’ll be able to redeem fewer miles for a ticket that may value greater than 10x as a lot when paying money. That is purely supposed to be an instance, however hopefully at the very least demonstrates the complexity of valuing these currencies.

Be conservative when valuing miles & factors

For quite a lot of causes, I attempt to be conservative in terms of valuing miles & factors:

- Miles & factors will be devalued by applications at any time, so it’s important to apply some type of a reduction to them to account for that; generally there’s rather more of a danger of devaluation for a person airline or lodge forex, fairly than a transferable factors forex

- With most applications, you don’t truly personal your miles & factors; they belong to this system, and also you’re simply allowed to make use of them so long as you could have an account in good standing

- Folks needs to be inspired to earn & burn, and creating an artificially excessive worth for factors discourages that

As you’ll be able to see, I worth bank card rewards factors greater than a overwhelming majority of particular person airline currencies, regardless that these are the perfect methods to redeem them. That’s as a result of I’m prepared to worth the factors at a premium for the added flexibility that they provide.

Valuing miles & factors is each absolute & relative

Developing with a valuation of a mile or level is each an absolute and relative train:

- The valuation needs to be absolute within the sense {that a} forex needs to be valued someplace between the everyday acquisition value and the everyday redemption value; on the finish of the day this is the reason I worth most of those currencies at someplace round one to 2 cents every

- It’s relative as a result of the way in which I give you differing valuations between currencies is predicated on the professionals & cons of redeeming with every program by way of redemption charges, routing guidelines, and extra

The way you’ll get essentially the most worth together with your miles & factors

Usually talking, if you wish to get essentially the most worth from miles & factors, there are two key facets to that:

- You need to spend a while finding out these applications, as a result of the offers available are in some instances wonderful

- Usually you’ll get essentially the most worth from factors in case you’re searching for aspirational redemptions, like staying at 5 star inns, or reserving worldwide first & enterprise class flights, the place the money worth could be disproportionately excessive

Admittedly that’s not how everybody desires to redeem, and that’s completely fantastic:

- In the event you don’t have a variety of factors, it’s in all probability not price investing the time to review these applications all that rigorously

- When you have a household with toddlers, then understandably your precedence may be touring to someplace shut by and having a room with a variety of area, fairly than flying midway all over the world to remain at a 5 star lodge

Don’t fall for the retail value fallacy

I believe it’s necessary to not get too carried away with factors valuations. For instance, above I confirmed a $12,000+ one-way top notch ticket from Newark to Frankfurt on Lufthansa that might be booked with 90,000 Aeroplan factors.

Sure, on the floor I suppose you’re getting over 13 cents of worth per level. Nevertheless, don’t deal with that an excessive amount of. For psychological accounting functions, personally I worth redemptions based mostly on how a lot I’d in any other case truly be prepared to pay for that have. I might by no means, ever drop that form of money on a one-way top notch ticket.

So whereas on paper that may be the valuation, I all the time ask myself how a lot I’d be prepared to pay for a firstclass ticket to Europe. Personally I’d estimate that I’d in all probability truly worth that flight at $1,500, by way of what I’d in any other case be prepared to pay.

I’m not trying to get into an enormous debate right here about perceived worth fairly than retail worth, however my level is that it’s necessary to contemplate how a lot you worth these premium experiences, fairly than simply how a lot they value.

Don’t make a journey simply because it could value so much when paying money, however fairly do what you wish to do, and attempt to maximize worth alongside the way in which. Not less than that’s my take.

Don’t worth miles & factors based mostly on one redemption

One other factor I contemplate with every factors forex is what number of good redemption choices there are. The extra flexibility and extra choices there are, essentially the most I worth these currencies. Don’t simply worth a factors forex based mostly on a single award ticket candy spot.

For instance, redeeming Virgin Atlantic Flying Membership factors on All Nippon Airways is an exceptional worth. Nevertheless, final yr we noticed the primary class redemption charges get devalued significantly, and on high of that, first and enterprise class award availability on ANA will be actually robust to come back by.

So when you may get a ton of worth from Virgin Atlantic Flying Membership factors in case you handle to seek out availability, you don’t wish to worth a forex completely based mostly on one redemption. I attempt to consider these candy spot redemptions whereas acknowledging that they supply restricted flexibility.

Backside line

Hopefully the above is a helpful rundown of the worth of varied bank card, airline, and lodge factors currencies. There’s no absolute proper or unsuitable technique to worth factors, and it’s completely cheap in case your valuation is completely different than mine. My aim is simply to share my take, and supply a common framework for valuing these currencies.

I’ll preserve my valuations up to date over time, to replicate adjustments with these varied factors currencies.

How do you go about valuing miles & factors, and are your valuations considerably completely different than any of mine?