Hyperlink: Apply now for the Ink Enterprise Most popular® Credit score Card, Ink Enterprise Money® Credit score Card, or Ink Enterprise Limitless® Credit score Card

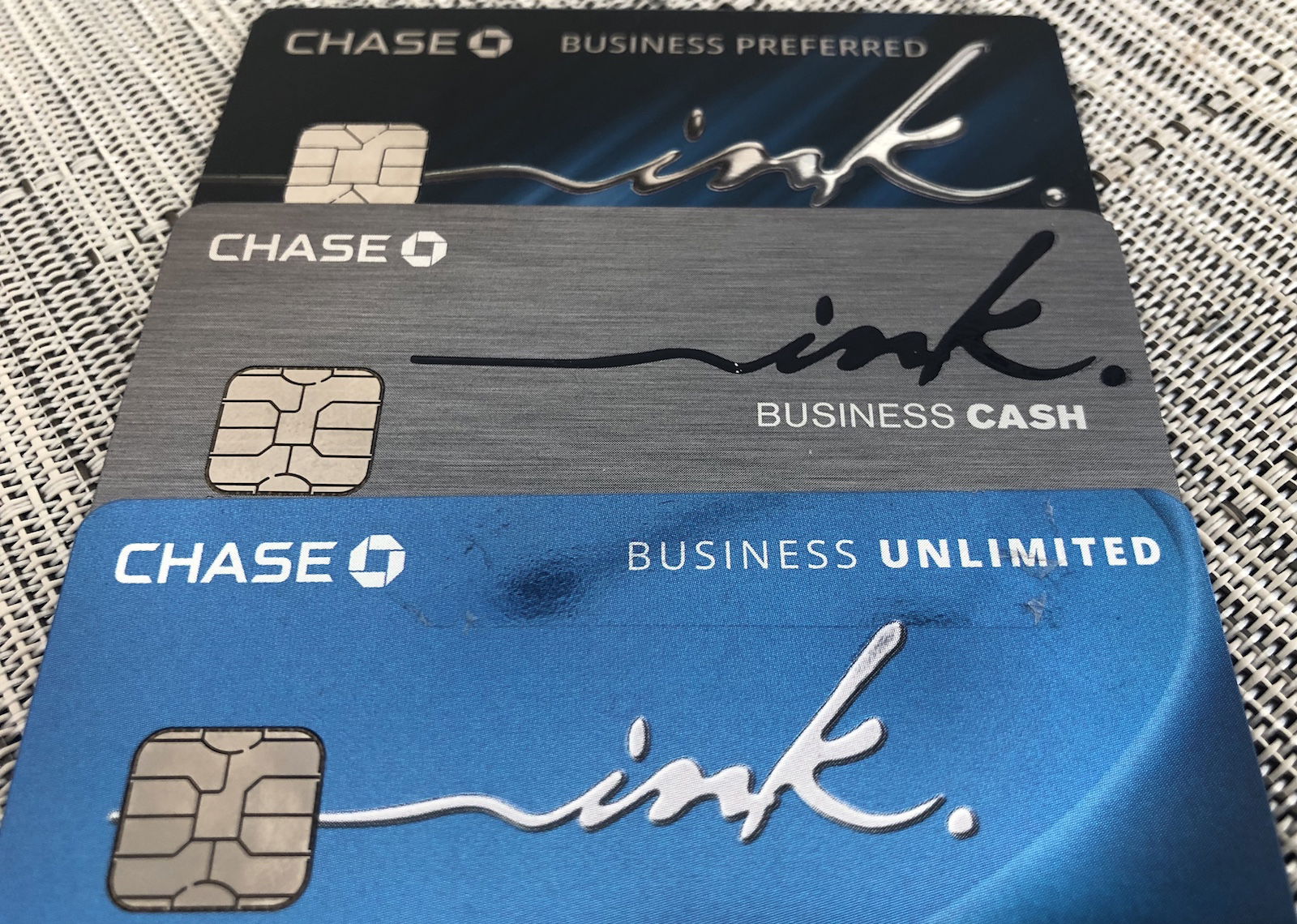

Whereas there are many wonderful enterprise bank cards on the market, I’d argue that the portfolio of Chase Ink Enterprise bank cards — together with the Ink Enterprise Most popular® Credit score Card, Ink Enterprise Money® Credit score Card, and Ink Enterprise Limitless® Credit score Card — are among the many most compelling. The playing cards have distinctive welcome bonuses, nice rewards constructions, and priceless perks.

On this submit I wished to cowl the fundamentals of those playing cards. Why are the playing cards value having, and how will you maximize your odds of getting authorized when making use of?

Fundamentals of Chase Ink Enterprise bank cards

Let’s begin by overlaying the fundamentals of Chase Ink Enterprise bank cards, together with the welcome bonuses, the rewards construction, the perks, and extra. As I view it, these playing cards are enhances fairly than substitutes, provided that just one card has an annual price, they usually every have totally different strengths.

These playing cards even have huge welcome bonuses, so making use of for a number of playing cards may be a good way to earn numerous factors with an inexpensive spending quantity, which may gasoline some nice journey alternatives.

Observe that on this submit I received’t be overlaying the Ink Enterprise Premier® Credit score Card (evaluation). Whereas this can be a doubtlessly helpful card, it completely earns money again, so it isn’t a journey rewards card, in contrast to the remainder of the playing cards within the portfolio.

Chase Ink Most popular Card fundamentals

The Ink Enterprise Most popular Card has an inexpensive $95 annual price, and the are so many causes to choose up this card:

- It has an enormous welcome bonus of 120,000 bonus factors after spending $8,000 inside three months

- It has a profitable rewards construction, because it provides 3x factors on journey, transport purchases, web, cable, telephone providers, and promoting purchases made with social media websites and search engines like google and yahoo, on as much as $150,000 in mixed purchases per cardmember 12 months

- It provides priceless perks, like mobile phone safety, rental automobile safety, and prolonged guarantee safety

- Having this card provides you full entry to the Chase Final Rewards ecosystem, together with the power to switch factors to journey companions

Learn a full evaluation of the Ink Enterprise Most popular Card.

Chase Ink Money Card fundamentals

The Ink Enterprise Money Card is a priceless no annual price card, and has a compelling worth proposition:

- It has a big welcome bonus of as much as 75,000 bonus factors — earn 35,000 factors after spending $3,000 inside three months, and an extra 40,000 factors after spending a complete of $6,000 inside six months

- It has a profitable rewards construction, because it provides 5x factors on workplace provide shops, web, cable, and telephones providers, and as much as 2x factors on eating places and fuel stations, on as much as $25,000 in mixed purchases per cardmember 12 months

- It provides priceless perks, like rental automobile safety and prolonged guarantee safety

- The cardboard solely provides the power to switch factors to Chase Final Rewards journey companions along side one other card

Learn a full evaluation of the Ink Enterprise Money Card.

Chase Ink Limitless Card fundamentals

The Ink Enterprise Limitless Card is a helpful no annual price card, and there are a number of causes you’d need to think about this card:

Learn a full evaluation of the Ink Enterprise Money Card.

Fundamentals of Chase Ink Enterprise bank card rewards

The worth of the factors you earn with Chase Ink Enterprise bank cards varies based mostly on which playing cards within the portfolio you’ve got. Assuming you’ve got the Ink Enterprise Most popular Card, then all of the factors you earn on these three playing cards might be redeemed in one in every of two methods.

One possibility is that they might be redeemed for 1.25 cents every towards the price of a journey buy by way of the Chase Journey Portal. If in case you have the Chase Sapphire Reserve® Card (evaluation), then all of the factors you earn might be redeemed for 1.5 cents every towards the price of a journey buy.

The second selection is that you could convert these factors into airline miles or resort factors, utilizing one of many Chase Final Rewards switch companions, which you’ll find under.

When you don’t have both the Ink Enterprise Most popular Card, Sapphire Reserve Card, or Sapphire Most popular Card, then factors earned on the Ink Money Card and Ink Limitless Card can solely be redeemed for a penny every, which isn’t practically pretty much as good. The important thing to maximizing worth is to construct up a portfolio of Chase playing cards.

Chase Ink Enterprise credit score credit score utility & approval ideas

With the above out of the way in which, let’s discuss a few of the logistics of making use of for and being authorized for Chase Ink Enterprise bank cards. The good factor is that you simply’re eligible for all three playing cards, together with the welcome provides.

For extra firsthand examples, see my current submit explaining Ink Enterprise Most popular Card eligibility, and likewise my expertise getting authorized for the cardboard.

Who’s eligible for Chase enterprise bank cards?

Eligibility for a small enterprise bank card is simpler than you may suppose. You don’t have to have an enormous firm, and don’t even have to be integrated. Even a small aspect enterprise with restricted enterprise income makes you eligible for a enterprise bank card, even should you’re simply promoting issues on eBay, do some consulting on the aspect, have a rental property, or do freelancing, for instance.

It goes with out saying that it’s best to at all times fill out bank card functions honestly.

What are restrictions on making use of for Chase enterprise playing cards?

Chase’s basic restrictions on making use of for playing cards are as follows:

- There’s no exhausting restrict on what number of Chase bank cards you may be authorized for, however fairly there’s typically a most quantity of credit score the financial institution is prepared to increase you, wherein case you might be requested to modify round your credit score limits on some playing cards as a way to facilitate an approval

- Whilst you can sometimes be authorized for as much as two Chase playing cards in a 30 day interval, that doesn’t normally work when each are enterprise playing cards; you sometimes need to wait at the very least 30 days between enterprise bank card functions to be on the protected aspect, although there are blended experiences (some individuals don’t have to attend that lengthy, others have to attend longer)

- Chase has the 5/24 rule, whereby you sometimes received’t be authorized for a Chase card should you’ve opened 5 or extra new card accounts prior to now 24 months; nonetheless, word that this now not appears to persistently be enforced

- Concerning the 5/24 rule, the excellent news is that whenever you’re authorized for a Chase enterprise bank card, that utility shouldn’t rely as an additional card towards the 5/24 restrict, provided that it received’t present up in your private credit score report

Are you able to earn the bonuses on a number of Chase enterprise playing cards?

You have to be shocked by how straightforward it’s to earn the bonuses on Chase Ink Enterprise bank cards:

- You may earn the bonus on every particular person card, in order that they’re not mutually unique

- You may even get a number of of the identical playing cards for various companies, so if you have already got a specific card for an organization, you may nonetheless get it for a sole proprietorship, for instance

- There’s no “lifetime language” with these playing cards, so that you’re eligible for the playing cards (together with the bonuses) even should you had them prior to now

How must you fill out Chase enterprise card functions?

Those that have already got enterprise bank cards are most likely conversant in the applying course of, however for many who aren’t, right here’s what it’s essential know. It may be intimidating to use to your first enterprise bank card, although even should you’re a small enterprise or sole proprietor, you need to be eligible.

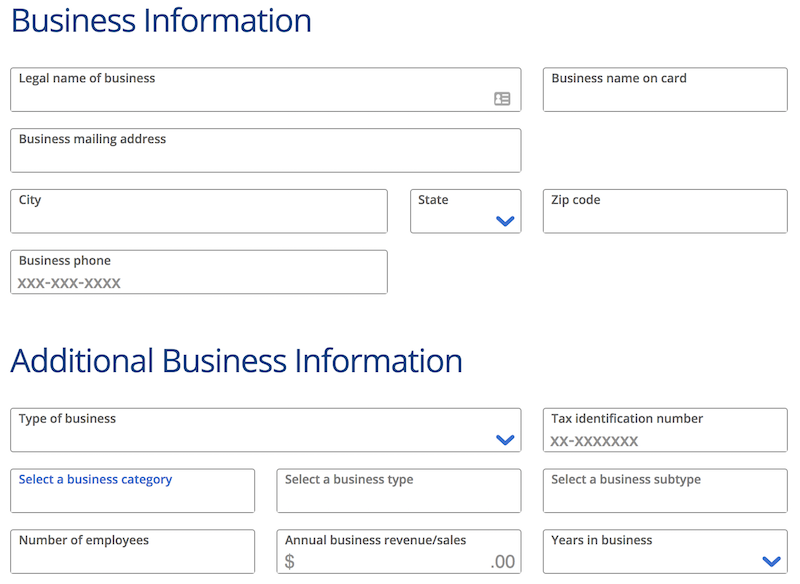

When making use of for a Chase enterprise bank card, you’ll be requested the next questions, along with the everyday private questions on your earnings, Social Safety Quantity, and many others.:

- Authorized identify of enterprise

- Enterprise mailing deal with & telephone quantity

- Kind of enterprise

- Tax identification quantity

- Variety of workers

- Annual enterprise income/gross sales

- Years in enterprise

When you’re a sole proprietor, how must you method this? To start with, and most significantly, reply every thing honestly. I feel the priority that lots of people have is that they suppose they want an integrated enterprise, a separate workplace, and many others., as a way to be thought of for a enterprise card. That’s not the case:

- You need to use your identify because the authorized identify of your corporation

- The enterprise mailing deal with and telephone quantity may be the identical as your private deal with and telephone quantity

- When you’re a sole proprietorship, you may choose that as your kind of enterprise

- For the tax identification quantity, you may put your Social Safety Quantity

- For variety of workers, saying only one is completely tremendous

- In your annual enterprise income, be sincere about what it’s

- For years in enterprise, there’s no disgrace in saying that it’s new, that it has been one to 2 years, and many others.

How exhausting is to get authorized for Chase enterprise card?

With regards to getting authorized for enterprise bank cards, Chase definitely isn’t the best issuer. Usually I discover American Categorical enterprise playing cards to be best to be authorized for. Nevertheless, getting authorized for Chase enterprise playing cards isn’t as robust as some individuals assume, at the very least you probably have wonderful credit score.

In my expertise prompt approvals on Chase enterprise playing cards are pretty uncommon, so don’t be fearful if the approval doesn’t come by way of instantly. You’ll normally get a pending choice response, after which finally (hopefully) an approval.

Nonetheless, generally prompt approvals do come by way of, and it’s at all times thrilling when that occurs. Simply don’t be shocked if it doesn’t.

How does the 5/24 rule affect Chase enterprise bank cards?

Chase has what’s often known as the 5/24 rule, whereby you sometimes received’t be authorized for a Chase card should you’ve opened 5 or extra new card accounts prior to now 24 months (nonetheless, there are more and more experiences that that is now not enforced).

One exception is most enterprise playing cards, together with these issued by American Categorical, Financial institution of America, Barclays, Capital One, Chase, and Citi, typically received’t rely as an extra card towards that restrict, as a result of they received’t be proven in your private credit score report.

One optimistic factor is that whereas Chase enterprise playing cards could also be subjected to the 5/24 rule, whenever you’re authorized for them, they don’t rely as an additional card towards that restrict.

In different phrases, should you’ve opened 4 new accounts prior to now 24 months after which apply for a Chase enterprise card, you’ll nonetheless be at 4 playing cards. When you then apply for an additional Chase enterprise card, you’ll nonetheless be at 4 playing cards.

How are you going to get authorized for all three Chase Ink Playing cards?

In case your aim is to be authorized for all three Ink playing cards, your finest technique is “gradual and regular,” as they are saying. I’d advocate making use of for the playing cards a bit over 30 days aside, on the absolute quickest. When you apply for the primary card on day one, apply for the second card on day 35 (or so), after which the final card on day 70 (or so). Or perhaps wait even longer between functions.

If it had been me, I’d undoubtedly advocate making the Ink Enterprise Most popular Card first, because it’s probably the most profitable, and has the very best bonus.

Then it’s important to resolve whether or not the Ink Enterprise Card Card or Ink Enterprise Limitless Card is a greater possibility for you because the second card to use for. If it had been me, I’d most likely apply for the Ink Enterprise Limitless Card, provided that it provides 1.5x factors on all purchases, so it properly balances the 3x factors classes on the Ink Enterprise Most popular Card.

I’d word that whereas that is the way it’s purported to work, Chase additionally generally has limits on how a lot credit score may be prolonged to somebody, so it’s completely doable that Chase will approve you for 2 of those, however not the third. Everybody’s state of affairs will differ.

Backside line

Chase has some implausible bank cards, and particularly, the issuer has nice enterprise bank cards. The lineup of Chase Ink Enterprise bank cards have some phenomenal bonuses, and between the Ink Enterprise Most popular Card, Ink Enterprise Money Card, and Ink Enterprise Limitless Card, you possibly can doubtlessly earn bonuses of 270,000 Final Rewards factors. That’s enormous.

Not solely do the playing cards have nice preliminary bonuses, however they’ve wonderful bonus classes, starting from 1.5x factors on all purchases, to 3-5x factors in choose classes.

Making use of for enterprise bank cards on the whole may be intimidating for brand new companies, although I like to recommend giving it a attempt utilizing the above ideas, and also you’ll most likely be pleasantly shocked by the outcomes.

Do you’ve got any Chase enterprise playing cards? In that case, what was your expertise getting authorized for them?